Banking

Transform your banking operations with our custom banking software solutions. At Reporteq, we offer specialized services to enhance your financial institution's efficiency and productivity. Our team is experienced in developing tailored software solutions specifically for the banking industry.

ACH & Check 21

ATM

Core Banking Systems

EMV

Mobile Banking App

Loan Servicing and Origination

Custom Loan Servicing and Origination Solutions

For financial services and institutions, our specialized loan servicing and origination solutions handle underwriting, origination, disbursement, servicing, amortization, processing, and much more.

Loan Servicing and Management Systems

For banks, credit unions, and other financial institutions, we provide specialized loan servicing systems and loan management systems (LMS), which are intended to track different loan kinds, such as personal loans.

Loan Settlement Software Platforms

Our skilled programmers develop platforms for loan debt repayment and settlement that allow automated clearing house (ACH) and electronic funds transfer (EFT) payments for all payment kinds. These platforms incorporate automatic billing and payments.

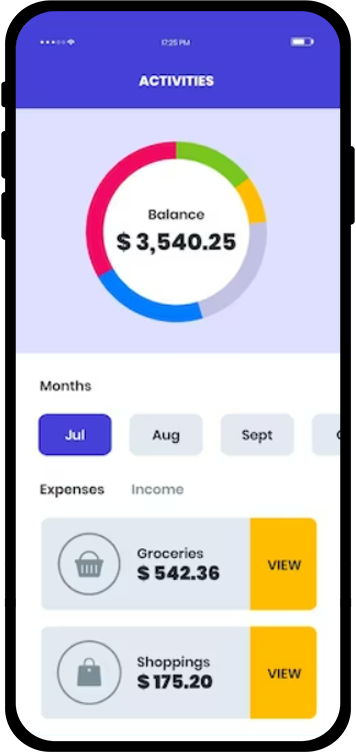

Custom Mobile Banking Software Solutions

We enable services like electronic bill payments, remote check deposits, peer-to-peer payments, fund transfers between accounts, text messaging, statement downloads, and printing to be customized by mobile banking software vendors.

Custom Mobile Banking Apps

Utilizing cross-platform development tools like Xamarin & PhoneGap, we create native mobile banking apps for iOS & Android that are quick and easy to use on smartphones, tablets, and wearable technology.

Core Banking System Integrations

Using RESTful APIs, we integrate mobile banking apps with a financial institution's back-end CORE banking system, enabling smooth cross-channel transactions and real-time money transfers between different accounts.

Check Remote Deposit Capture

In accordance with Check 21 regulations, our programmers use Remote Deposit Capture (RDC) modules that are integrated with your device's camera feature to enable check truncation and conversion of checks into ACH transactions.

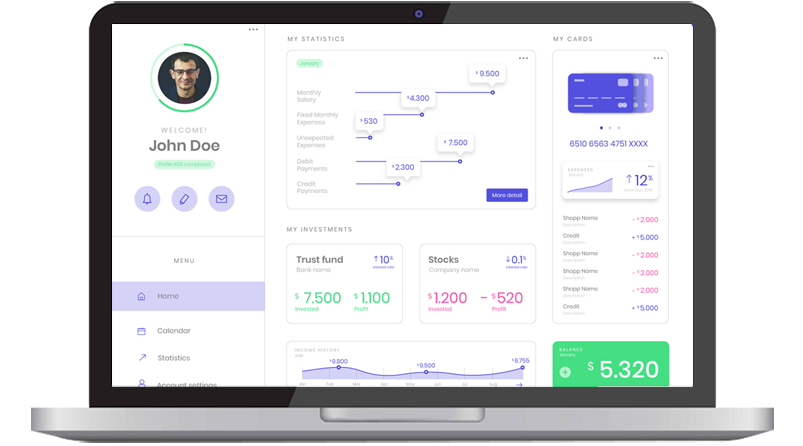

Custom Online Banking Software Systems

For brick-and-mortar and online financial services companies of any size, our developers provide dependable, simple customizations to online banking software systems that combine branding for improved consistency & exposure.

Custom Online Banking Platforms

Our cutting-edge technologies are extremely safe, enabling encrypted bi-directional transactions and offering ground-breaking solutions for cryptocurrency trading, crowdfunding, multi-currency e-wallets, and direct money transfers via social media.

Custom Online Banking Security

The risk management tools and network security features that our banking solutions specialists apply include TCI/IP, SSL/TLS, Multi-Factor Authentication (MFA), One-Time Passwords (OTP), Single Sign-On (SSO), and SSH File Transfer Protocol (SFTP).

Custom Online Banking Apps

With hybrid mobile banking apps that employ tools like PhoneGap to deliver consistent user experiences across all digital channels, including web, iOS, and Android, our banking software professionals make it simple for your consumers to bank on the move.

Custom ATM Software Development

Our banking software developers are leaders in the field, customizing and configuring current ATM software as well as offering complete end-to-end ATM software development services to domestic and foreign financial institutions.

ATM Hardware Integrations

Our programmers provide multi-vendor software with integrations to a range of hardware platforms, including card dispensers, bill dispensers, and credit and debit card readers (MagTek, ID TECH, VeriFone, and Ingenico) (LG, Fujitsu).

ATM Monitoring Systems

Our programmers create back-end and admin portal programming, automatic system updates, and enterprise-wide ATM management software for remote diagnostics and monitoring in a self-service network.

ATM Management Solutions

We update CORE banking systems with cutting-edge interface solutions that can be accessed through a vast network of ATMs, self-service kiosks, and mobile devices. These solutions are intended to improve the customer experience by offering individualized choices.

ATM Migration Solutions

Our talented data migration specialists create software on a specific basis for EMV migrations, banking CRM interfaces with Business Intelligence (BI) software, many fraud protection features, and enhanced transaction capabilities.

Custom Core Banking Solutions

All of a bank's most frequent transactions, such as creating and servicing loans, opening new accounts, and processing cash deposits and withdrawals, are easily supported by our developers' Centralized Online Real-Time Exchange (CORE) banking software services.

CORE Banking Software Solutions

With configurable CORE system platforms that make use of Java-based architectures and Service-Oriented Architectures (SOA) compatible with current software and external networks, our programmers completely automate all banking system activities.

CORE Security & Compliance

To safeguard clients, fulfill government and industry requirements, provide security auditing, and prevent data breaches with recovery capabilities consistent with Anti-Money Laundering (AML) rules, we design secure, modular CORE banking systems.

CORE API Integrations

We create safe API parts that connect to internet, mobile, SMS, ATM, and other financial distribution channels. We also incorporate sociable user interfaces with third-party APIs to adopt real-time processing and remote capturing capabilities.

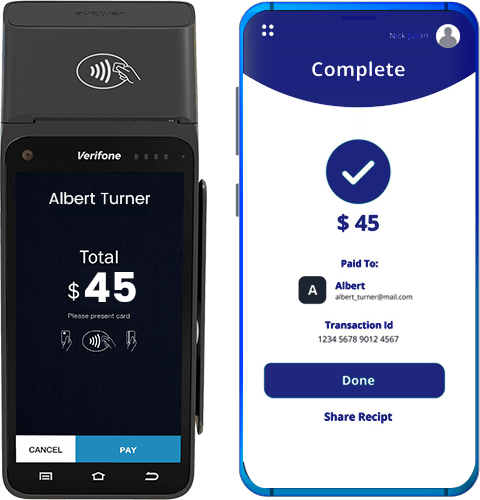

Custom EMV Software Solutions

We offer a complete, wide variety of EMV software solutions, from advanced feature implementation to custom-coded programming, enabling institutions to transmit secure data in delicate settings.

EMV Software Development

We provide expert end-to-end EMV migration services, including software development, testing, and validation for fully integrated and partially integrated solutions.

EMV Security Solutions

We create bespoke embedded software that complies with tokenization data security methods, such as End-to-End (E2E) and Point-to-Point (P2P) encryption and 3-D Secure (3DS) authentication.

EMV Programming Services

We create card reader solutions such as the Verifone VX/MX/UX series, the Ingenico iPP/iCT/iSC/iWL series, and more that are PCI PTS 3.x/4.x certified and support EMV Levels 1, 2, and 3.

EMV Testing & Certification

We test and certify using a variety of tools, including the Visa Acquirer Device Validation Toolkit (ADVT), MasterCard Terminal Integration Process (M-TIP), and Terminal Quality Management (TQM).

Check 21 Software & ACH Processing Solutions

In order to smoothly integrate credit card processing, e-check processing, secure verification systems, and improved UX designs, we adapt your ACH payment processing and Check 21 capabilities.

ACH eCheck Solutions

With modules to automate ACH file creation, check verification, transmission to different financial institutions, and development of Remotely Created Check (RCC) pictures for deposits, we build specialized programming platforms for processing ACH payments.

Check 21 & Electronic Check Processing Services

Our programmers create unique check imaging platforms for e-payment processing integrations and Check 21 truncation solutions to work with MICR check scanner hardware from RDM, Panini, Canon, Epson, and Burroughs.

ACH Payment System Integration

To maintain accounts, routing numbers, check imaging remittance, automated clearing, and any other crucial customer information via the cloud and/or mobile devices, we offer safe ACH database construction connected with CRM platforms.